2020 Park City Real Estate Trends (archived)

This information was initially posted on Derrik Carlson's Market Updates for Park City & Deer Valley Real Estate Trends - 2020 to Today, which is continually updated with current real estate trends for Park City, Utah. This page has been backdated and archived to improve page speed and performance.

While moving from the original page linked above, my mind started racing about everything we've been through for the past several years. When I started posting about Park City Real Estate Trends and planned on keeping it updated, we were told that one in four people we knew would die from COVID-19. Not only would I lose a quarter of my loved ones, but I'd also essentially be out of a job and living off of saving because there wouldn't be anyone to buy real estate in Park City.

At this time, travel was shut down, and I was locked in my home, wondering about my future. I actually wrote a five-page blog post about what would happen to real estate in Park City and nationally as COVID took over the world. Sometimes the best medicine is to get back to work so I started picking up the phone.

I remember calling a lead that signed up for my website, and she started yelling at me because she was in New York and everyone around her was dying. Frankly, I wondered why she give me her phone number and asked me to call, but I apologized and moved on. During this time, I was either eating the bread my wife Holly learned to bake or making up to 300 phone calls daily to check in and chat.

I was trying to figure out what was going on in this world. As the lockdown broke free, it was like the floodgates of buyers burst open. We went from over 1,200 listings on the market to a point where there wasn't anything to show someone looking for a property. When Park City real estate did hit the MLS, there were buyers walking over one another and up to 20 offers - it was awful and a blessing at the same time. Because of my phone calls and compassion throughout the lockdown, the year ended up being a banner year, but 2021 would be even better.

Enjoy the updates from 2020 below, and as always, I'm only a phone call away if you need anything regarding Real Estate in Park City

Detailed Analysis of Park City Real Estate: A Look at 2020-2022 Trends

This section of our report delves into the real estate dynamics within Park City limits and the Snyderville Basin, spanning the years 2020 through 2022, focusing on the areas identified by the zip codes 84060 and 84098. Our analysis is underpinned by the comprehensive statistics provided by the Park City Board of Realtors, distinguishing our review with its precision and depth.

Our methodology sets us apart from other entities, as we exclusively concentrate on Park City and Deer Valley, unlike others who might merge data from these locales with that of neighboring regions. This specificity aligns with our expertise and commitment to these prime real estate markets.

To enhance accessibility and review efficiency, we have systematically organized our previous findings into an archive. Below are the links to our archived reports, which present a detailed exploration of the market trends influencing real estate in Park City over the noted periods:

- Current Park City Real Estate Trends

- 2024 Market Stats for Park City, Utah

- 2023 Park City Market Stats

- 2022 Park City Market Stats

- 2021 Park City Market Report

These documents serve as a valuable resource for stakeholders, offering a clear and detailed perspective on the market's progression and the factors driving changes in Park City's real estate landscape.

2020 4th Quarter Real Estate Market Report [Homes & Condos]

Single Family Home Sales for 2015 to 2020:

| Yr. | # Sales | Median $ | Ave $ | $Sq Ft |

|

20' |

815 | $1,896,950 | $2,475,510 | $465 |

|

19' |

552 | $1,514,850 | $1,983,340 | $384 |

| 18' | 521 | $1,440,000 | $1,935,665 | $379 |

| 17' | 567 | $1,250,000 | $1,755,715 | $339 |

| 16' | 522 | $1,137,330 | $1,782,905 | $330 |

| 15' | 502 | $1,100,000 | $1,621,118 | $311 |

Park City Condo Sales for 2015 to 2020:

| Yr. | # Sales | Median $ | Ave $ | $Sq Ft |

| 20' | 935 | $699,000 | $1,044,305 | $544 |

|

19' |

746 | $700,000 | $999,976 | $492 |

| 18' | 586 | $641,250 | $1,024,884 | $468 |

| 17' | 656 | $577,000 | $906,267 | $413 |

| 16' | 626 | $538,500 | $833,809 | $383 |

| 15' | 694 | $450,000 | $696,703 | $335 |

My Review of the Park City Real Estate Market of 2020: The Park City Real Estate Boom!

In 2020, we started busier than ever - then COVID-19 hit and stalled the market. However, sales did not stop during the pandemic, and I sold most of my listings at the same price I quoted the sellers the property was worth a few months prior.

In 2020, we started busier than ever - then COVID-19 hit and stalled the market. However, sales did not stop during the pandemic, and I sold most of my listings at the same price I quoted the sellers the property was worth a few months prior.

During the lockdown, I stayed on the phone calling potential buyers. We focus on helping second homeowners or vacation property buyers know and understand the local markets. When travel resumed and lockdowns were lifted, the market took off at a pace that no one had ever seen before. I've been selling real estate in Park City since 2012, and for the first time in my career, there was a sense of urgency in the luxury real estate market - speed was in all markets!

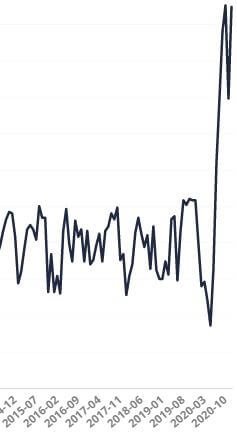

The photo on the right shows the number of sales of homes and condos in Park City for 2020, peaking at 262 in October - that's more than we sold in the first quarter of 2019.

Showings felt like they started to normalize by October, and a large percentage of the 32 buyers and sellers helped in 2020 closed around that same time. At one point, I had sixteen properties under contract simultaneously. The sweet spot in the market for the clients I represented was $1,800,000 to $4,000,000. Several buyers knew where they wanted to buy in Park City, but because I like to do a complete market overview before buying, many purchased in communities they didn't expect.

Ten years ago, someone would say they wanted to live in Park City or Deer Valley, which meant from the White Barn into town, but now Park City means an area that covers from Pinebrook to Deer Valley and out to Jordanelle. Over the past few years, I've refined my techniques to get buyers and sellers enough information in a short enough amount of time that they feel comfortable deciding.

The typical client I work with is within five years of retiring, and thinking about the future lifestyle they can have in Park City or their property is what will keep their loved ones coming back together for years to come. So their purchase tends to be a lifestyle choice, and Park City is where they can enjoy the fruits of their labor.

The Park City area tends to win out over other mountain ski towns because of the proximity to the Salt Lake International Airport and easy travel. Everyone has to be within an hour of a major airport.

Except for wearing a mask, life in Park City has essentially been normal for most of the year. We have shut off the news and have focused on helping clients buy or sell real estate in Park City.

Currently, we have five properties under contract in Park City, six in the Jordanelle area, and two single-family homes in the towns surrounding Park City. As usual, but better than expected, Deer Valley and the ski properties in Park City have been better than ever for us. In addition, as Promontory heated up in 2020, we were able to help several clients get into some remarkable properties.

Park City Luxury Real Estate Market Review 2020

In winding down the review for 2020, I'd like to look at the luxury market of Park City homes that sold above $4,000,000.

The number of high-end homes with a sales price of over $4,000,000 or above was 241%. The median price was increased by 8% to $5,692,500 vs. last year and lower than it was in 2015 through 2018. In this price range, COVID was more like a death of a loved one where people realized it was time to live life and it was okay to take money out of the stock market.

If you had your Park City luxury home on the market and it didn't sell in 2020, the house was either overpriced by 15%, or there wasn't enough marketing behind it. This year we were fortunate enough to list multiple homes for sale for over $4,000,000 and sell them by the end of the year.

12 Month Year-Over-Year | Comparing Dec - Jan 2019 vs. Dec - Jan 2020

Below is a comparison of the Park City single-family home market in 2019 versus 2020. The blue links below will take you to the specific neighborhood page for that area. Many in-town communities were up over 100% in quantity sold (qty sold). The neighborhood of Aerie was up 200% and essentially sold out of homes. There has been limited inventory over the second part of the year.

Don't be taken aback by the change in the median sales price. I believe that the upper end of the market is taking off, and it drastically skewed the difference (Δ) in median pricing.

| Park City | Qty Sold | Volume Sold | Vol. Δ | Median Sale | Med. Δ |

| Old Town | 102% | $230,295,336 | 118% | $2,025,000 | 11% |

| Thaynes Canyon | 127% | $83,024,500 | 311% | $2,500,000 | 35% |

| Lower Deer Valley | 115% | $74,859,933 | 133% | $2,525,000 | 12% |

| Deer Crest | 160% | $86,859,833 | 89% | $6,600,000 | -3% |

| Upper Deer Valley | 0% | $105,665,666 | -4% | $4,612,500 | 4% |

| Empire Pass | N/A | $35,565,000 | N/A | $5,850,000 | N/A |

| Aerie | 200% | $48,927,310 | 223% | $3,020,500 | 0% |

| Propsector | 22% | $26,572,800 | 32% | $1,282,554 | 11% |

| Park Meadows | 18% | $197,301,914 | 45% | $2,620,000 | 36% |

| Canyons Village | 56% | $169,016,000 | 98% | $6,800,000 | 25% |

| Sun Peak | 24% | $53,401,137 | 27% | $1,275,000 | -15% |

| Silver Springs | 16% | $47,128,000 | 16% | $1,245,000 | 8% |

| Old Ranch Road | 33% | $73,712,640 | 345% | $3,369,320 | 21% |

| Kimball | -8% | $10,350,000 | 78% | $732,500 | 16% |

| Pinebrook | 2% | $71,328,315 | 37% | $1,185,000 | 3% |

| Summit Park | 90% | $27,328,315 | 2% | $800,000 | 10% |

| Jeremy Ranch | 107% | $83,271,100 | 11% | $1,320,000 | 20% |

| Glenwild | 25% | $152,908,393 | 148% | $3,395,000 | 39% |

| Silver Creek | 107% | $61,227,660 | 170% | $1,560,000 | 30% |

| Trailside Park | 26% | $39,845,700 | 45% | $840,600 | -4% |

| Promontory | 76% | $390,478,089 | 104% | $2,462,899 | 10% |

| Jordanelle | 71% | $242,191,369 | 97% | $2,457,500 | 12% |

December 2020 Market Statistics:

Single Family Home Statistics - The median price for single-family homes for December in Park City was $2,450,000, and the average price per square foot was down 2.3% to $535 per square foot.

There were 82 single-family homes sold, and they averaged five days on the market. The average seller received 97.9% of the asking price.

December 2020 Condominium Statistics -The median sale price for a Park City condominium was $515,000, and the average price per square foot was up 47.3% to $828 per square foot in December.

One hundred eighty condos sold in Park City, up from 99, averaged 0 days on the market. Sellers received 98.7% of the asking price.

When looking at the average days on the market, some properties in Park City sell within the first few days, while overpriced or makeover properties can take several months to sell. These statics include all the properties within city limits and properties that may not be within the city limits but use a Park City address.

Park City Real Estate Update from November 2020

We have officially entered the shoulder seasons where the market tends to slow down. As a Park City Realtor, it almost feels slow after the busiest summer on record. Although the market naturally slowed, if an excellent property hits under $3,000,000, it tends to sell within a week.

This week's new listings align with last year, but pended contracts are still more than double the same week the previous year, 64 to 30.

Closings for 2020 are up by 498 vs. the same timeframe of last year. The surprising thing is that with new construction not fully reported but having buyer's money becomes non-refundable, these numbers could be higher.

The number of properties available for sale in Park City has fallen to 985. Before August, Inventory had dropped below 1,800 units only five times in the past eight years and was over 42% lower than the previous record. The direction of Park City real estate inventory over the past four months is downward-pointing and steeply downward.

With the upcoming holiday season, when people tend to hold off listing their property for sale, we can only expect the number of available listings to continue to drop before our standard increase in January.

Has everyone who wanted to sell in Park City already put their property on the market?

The Most Recent Real Estate Highlights:

-

New listings have seen a significant decline in the past few weeks. The total number of new listings is down by 132 this year.

-

Pending contracts this week hit 64, which is more than double last year's number of 30.

- Closings in the past month are 109 more than in 2019.

-

Inventory continues to be an issue. Quality properties are listed for buyers ready to buy, but you need to act fast to get the property you want. I've been able to negotiate great deals or find them off-market properties.

- The Park City luxury homes have been highly active! There are currently 75 single-family homes for sale, 16 in escrow, and 63 for the number of homes sold within the past six months over $5,000,000. A significant portion of higher-end properties are in Deer Valley, The Canyons, or Promontory.

KEY POINTS: UPDATE 12/7/2020

We have officially entered the shoulder seasons where the market tends to slow down. As a Park City Realtor, it almost feels slow after the busiest summer on record. Although the market naturally slowed, if an excellent property hits under $3,000,000, it tends to sell within a week.

This week's new listings align with last year, but pended contracts are still more than double the same week the previous year, 64 to 30.

Closings for 2020 are up by 498 vs. the same timeframe of last year. The surprising thing is that with new construction not fully reported but having buyer's money becomes non-refundable, these numbers may be higher in reality.

The number of properties available for sale in Park City has fallen to 985. Before August, Inventory had dropped below 1,800 units only five times in the past eight years and was over 42% lower than the previous record. The direction of Park City real estate inventory over the past four months is downward-pointing and steeply downward.

With the upcoming holiday season, when people tend to hold off listing their property for sale, we can only expect the number of available listings to continue to drop before our standard increase in January.

November 2020 Market Statistics for Park City, Utah

Single Family Home Stats - The median price for single-family homes in Park City was $2,122,500 for November 2020, and the average price per square foot was up 5.5% to $548 per square foot.

There were 100 single-family homes sold, and they averaged 32 days on the market. The average seller received 98.4% of the asking price.

Condo Stats - The median sale price for a Park City condominium was $775,000, and the average price per square foot was up 8.1% to $565 per square foot in November.

There were 99 condos sold in Park City that averaged 35 days on the market. Sellers received 98.3% of the asking price.

When looking at the average days on the market, some properties in Park City sell within the first few days, while overpriced or makeover properties can take several months to sell. These statics include all the properties within city limits and properties that may not be within the city limits but use a Park City address.

Basic Stats of Park City Homes and Condos for Sale | 12/7/2020:

- Average List Price: $2,736,885

- Total Listings: 431

- Avg. Days on Market: 195

- Avg. Price/SQFT: $798

- Highest Priced Home in Park City: $38,000,000

- Lowest: $170,000

- Average Age of Property: 14 Years

Luxury Real Estate Market Update: $1,000,000 to $6,000,000 +

Luxury Statistics for Park City Homes for Sale on December 7, 2020

The luxury home market has continued to tighten. We saw a big wave of luxury home buyers hit the market over the summer and draw the inventory to where no one has ever seen it before. Many of the older homes in Park City have excellent locations and views but need a facelift or light remodel.

My business is built around luxury resort homes and vacation properties. So I have great connections for whatever you need when buying a luxury property in Park City or Deer Valley.

Luxury Home Update by Price Range

| Price Range | Active | Pend | 12 Mo Sold | Sales/Mo | Mo. of Supply |

| $1m to $2m | 51 | 65 | 406 | 33.8 | 1.5 (45 days) |

| $2m to $3m | 40 | 50 | 234 | 19.5 | 2 (60 days) |

| $3m to $4m | 28 | 20 | 110 | 9.16 | Three mo. |

| $4m to $5m | 19 | 14 | 57 | 4.75 | 14 mo. |

| $5m to $6m | 14 | 6 | 25 | 2.08 | 6.73 mo. |

| $6m+ | 48 | 10 | 51 | 4.25 | 11.29 mo. |

Where are People Moving from When they Move to Park City?

For the time being, COVID has changed the shape of Park City's real estate market. Many of my clients are wondering where people are coming from when they are buying here and all over is what it feels like, but I'm a statistical guy, so I pulled the Summit County tax data for a better reference.

Out of the 550 transactions, over $1,000,000, Utah has 307, which is 55% of the market share and right in line. If I remove Utah from the numbers, there have been 243 transactions, and California tops the list, followed by Texas, Florida, Nevada, & Illinois.

Below is a chart to show the number of buyers that are non-Utah. (Updated 9/21/2020)

| State | # | % of Non-Utah Buyers |

| CA | 74 | 30.45% |

| TX | 36 | 14.81% |

| FL | 22 | 9.05% |

| NV | 15 | 6.17% |

| IL | 13 | 5.35% |

| AZ | 9 | 3.70% |

| GA | 7 | 2.88% |

| OH | 7 | 2.88% |

August 1st Update for July 2020

The market feels like it is on fire right now. Pending contracts (homes going under contract) for 2020 have outpaced last year for the fourteenth consecutive week. New listings and homes going under contract show the market's direction and are a leading indicator of supply and demand. We are in a seller's market with more than twice as many properties going under contract this past week compared to 2019. Since the worst of COVID in April, pended sales are up 55% this year.

The market feels like it is on fire right now. Pending contracts (homes going under contract) for 2020 have outpaced last year for the fourteenth consecutive week. New listings and homes going under contract show the market's direction and are a leading indicator of supply and demand. We are in a seller's market with more than twice as many properties going under contract this past week compared to 2019. Since the worst of COVID in April, pended sales are up 55% this year.

Although sales dipped this past week, we expect to increase from the end of the month's closings. Total closings for the past six weeks are up 23% vs. last year. As a result, national home sales are expected to increase by 4.3% in 2020.

Where is the Park City Real Estate Market Heading?

When the East Coast (New York, New Jersey, etc.) opens, I expect to see another batch of home buyers coming into town. For the most part, people considering moving to Park City are trying to escape the big city or the hefty taxes of other states. Several clients plan to move to Park City for six months and one day to establish residency in Utah and have a higher quality of life.

Mortgage rates are so low that affordability seems higher this year than last. As a result, buyers who would typically pay cash for a property consider financing.

Out of the 137 reported closings for last month, 79 (57.66%) used financing. The financing vs. cash ratio is usually around 50%. There is a little arbitrage if you can buy a property with a rate lower than 3%, and appreciation is projected at 7%.

Below is Historical Information from Past Real Estate Market Updates in 2020

July 1 Update for June 2020

The Coronavirus has affected the Park City real estate market, but we are starting to return to normal. If it weren't for people wearing masks, life would feel 95% normal, with a regular shoulder season between the ski resorts closing for the seasons and waiting for the muddy trails to dry up.

We are in unique times where real estate occupations such as Realtors, builders, inspectors, and title companies are essential. People have continued to buy and sell property in the Park City area. What wasn't deemed essential was keeping the ski resorts open and potential buyers traveling to Park City.

Approximately half of the properties in Park City, Utah, are second homes. When fifty percent of buyers are taken away, you would expect sales to almost completely dry up within forty-five days. However, that has not happened, and our new under-contract numbers for the past four weeks have been right in line with 2019.

Luxury Update: Completed July 1, for June 2020

Update 7/1/2020: The Park City luxury real estate market is coming out of the COVID downturn with force. New pending sales have increased at every price point and are dramatic in percentages of increase, aside from the $2,000,000 to $3,000,000 price range. With new listings coming on the market, the months of supply are relatively the same for all categories.

| Price Range | Active | Pend | 12 Mo Sold | Sales/Mo | Mo. of Supply |

| $1m to $2m | 173 | 81 | 342 | 28.5 | 6.1 |

| $2m to $3m | 85 | 58 | 147 | 12.3 | 6.9 |

| $3m to $4m | 75 | 29 | 68 | 5.7 | 13.2 |

| $4m to $5m | 51 | 12 | 23 | 1.9 | 26.6 |

| $5m to $6m | 28 | 3 | 7 | 0.6 | 48.0 |

| $6m+ | 51 | 11 | 21 | 1.8 | 29.1 |

Luxury real estate update on June 1 Update for May 2020 (Historical)

Update 6/1/2020: Properties over $3,000,000 are lagging, with out-of-state buyers not coming to Park City. June & July will be busy months as potential buyers can vacation in Park City. We are now seeing some closings from sellers eager to sell at the height of the Coronavirus, and I suspect they have seller's remorse. Riches tend to follow the bold buyers in Park City. Sellers and buyers are still high on the future of Park City real estate.

Update 6/1/2020: How's the Luxury Market Functioning During COVID-19?

I was curious how our luxury market is functioning, considering many buyers for luxury properties are trapped out of state and not yet flying. Personally, my June and July are shaping up quite nicely for buyers coming into town in the $2,000,000 range to $3,000,000. June and July will be telling for the $3,000,000+ market and its direction.

Below is a quick look at the market of over $1,000,000 in Park City, Utah. The data below reviews the timeline from June 1, 2019, until June 1, 2020.

Total Active Residential Listings in Park City = 1,225 as of 6/19/2020

| Price Range | Active | Pending | Sold Past 12 mo | Sales/Mo | Months of Supply |

| $1m to $2m | 172 | 56 | 346 | 28.8 | 6.0 |

| $2m to $3m | 81 | 29 | 146 | 12.2 | 6.7 |

| $3m to $4m | 66 | 26 | 66 | 5.5 | 12.0 |

| $4m to $5m | 51 | 7 | 21 | 1.8 | 29.1 |

| $5m to $6m | 27 | 0 | 7 | 0.6 | 46.3 |

| $6m+ | 48 | 5* | 21 | 1.8 | 27.4 |

*The five properties pending over $6,000,000 are all new construction.

A Bit of My Perspective:

I've been on the phone talking to as many people as possible that were once interested in buying real estate in Park City. I've realized that the Coronavirus has amplified life goals to help people finally decide to purchase a vacation property, pull up their roots and move here, or go in another direction. There are very few people on the fence.

It has been incredible to hear how different this experience has been in other areas of the country. People that live in the populated areas of New York, California, New Jersey, and Illinois areas are anxious to move to a slower and possibly safer way of life. If Park City can catch just a fraction of buyers moving out of these areas, I suspect prices will remain strong and perhaps even push up for primary residence-type properties.

It's yet to be seen how luxury real estate will react to the economic slowdown/shutoff. Smaller properties used as investment properties could be affected the most if there are issues with the ski resorts opening up to total capacity.

The Future of the Park City Real Estate Market

The conversations I've had led me to believe that there is a strong appetite for Park City properties from $1,000,000 to $3,500,000. In Park City, buyers don't have to buy, sellers don't have to sell, but everyone wants to be here - that's the truth! In addition, about half of the properties that have been purchased in Park City over the past decade have been 100% cash transactions, so many of our sellers don't have a debt obligation to unload if the economy doesn't bounce back quickly.

Many of my clients are small business owners, CEOs, hedge fund managers, or retirees with solid assets, so they won't need to liquidate their property to stay alive - we live in a unique semi-protected bubble here. I think we will have to wait this out a bit longer to see how the economy restarts to get a good feeling on the overall sense of the long-term direction of Park City real estate values.

Park City Real Estate Data During Coronavirus:

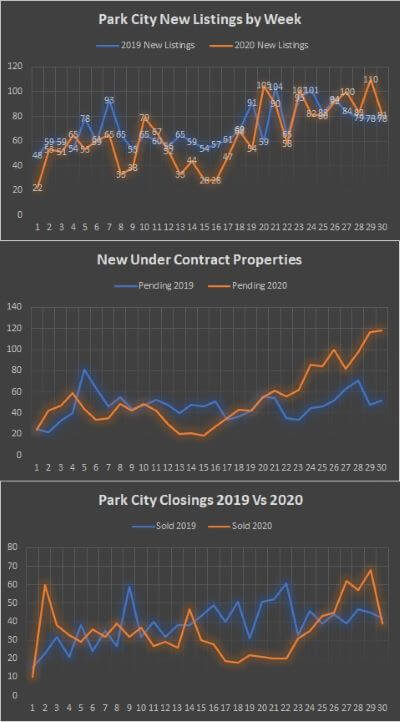

Below are charts and graphs that compare the exact timelines of 2019 to COVID-19 2020. When the stock market was falling, there were real estate "experts" telling real estate agents to buckle down for a significant downturn and slowdown of the real estate market in America - now they are saying to get ready for a mini-boom with buyers prepared to make considerable changes in their life. The past four weeks of pending sales tell about how people feel about Park City real estate. So let's get into the Park City Real Estate Market Report data.

New Listings By Week:

The number of transactions bottomed out in weeks 15 and 16. Since week 17, late April, we have seen the market become more active with new listings. Hope has been high that we'll make it out of this bumped and bruised rather than scarred. The upward trend reversed in week 19 as new listings dropped by 20% but week 20 more than made up for the difference by nearly doubling the previous week. Week 20 is the highest number of new listings in 2019 and 2020. The market is starting to react to relaxing coronavirus restrictions.

Update 5/28/2020:

- We decreased 15 new listings compared to last year, 104 in 2019, down to 89 in 2020.

- Pending listings were up by four properties, 54 to 48. This statistic is shocking since many out-of-state buyers still can't make it to Park City to view real estate for sale.

- Lastly, new sales are down 33 properties because of the lockdown. We went from 52 in 2019 to 19 in 2020, down 33, but with the pending listings being in line with last year, we should be over the worst of the lockdown.

Update 6/4/2020:

- There were 54 new listings compared to 65 in 2019 - Down 11 New Listings.

- Pending sales were 55 this week compared to 35 in 2019 - Up 20 for Pended Listings.

- Closings are still down because of the lockdown - this week, we had 17 closings compared to 61 last year. So closings are down by 44 - OUCH!

Update 6/17/2020:

- Updated Graphs Above

- You would think New Listings would be up more with how many sellers pulled their homes off the market, but they still seem to be in line with last year.

- New Under Contracts have been substantially higher in the past few weeks. I've been fortunate enough to add a few new pending sales.

- We see the 2020 sales be more in line with 2019.

- Since April 20, 2020, it has outpaced 2019 under contracts by 98 total properties.

Update 6/25/2020:

- Under contracts are higher than in 2019, a trend we have seen for the past four weeks and seven of the previous eight weeks. The overall dollar volume is up 30% from last year. This could be that the buyers of Park City are looking to move to Park City full-time or second homes more than condominiums.

- New Listings for this week vs. the same week last year are very similar. Total inventory, which includes all property types, is slightly down this week at 2,030 properties. The most recent peak was in October 2019, with 2,057 properties.

- The Park City Board of Realtors has been able to track the number of showings by our lockbox openings. Showings are up this past week as well.

Key points: Updated 8/10/2020

We have been seeing the Park City real estate market function similar to last year in recent weeks. Primary indicators continue to point in the right direction.

Highlights:

- New listings continued solid performance with residential real estate. In the past five weeks, new listings totaled 459 compared to 364 in the same period last year, increasing 26%.

- Pending volume for the past fifteen weeks is 59% higher than last year. For the third week in a row, new Pendings were double (or nearly so) the count from the same week in 2019.

- We're also back on a torrid pace for Closings. In six of the last seven weeks, closing totals exceeded those of the same week a year earlier. (Late reports brought up the count from last week, but we still missed by one closing.) Still, in the past seven weeks, we closed 407 transactions, up from 326 the year before (25% higher).

- July was an incredibly successful month for me. While many buyers are starting to understand the market, several buyers have put in offers on their first trip & some have made offers after seeing a property on video. I've shown 20+ different groups of buyers' property this month which is about three times more than usual for this time of year.

Key points: Updated 9/10/2020

In recent weeks, we have seen the Park City real estate market outpace 2019 and remain strong. Since June, I've been saying that we'll look back at the entire year, and we won't be able to tell there was a shutdown. Now, it appears 2020 will be a banner year for real estate in Park City.

The Most Recent Real Estate Highlights:

-

New listings topped last week's excellent tally of 99 by three, up to 102, and continuing our streak of beating the same week a year ago. Residential new listings in the past ten weeks totaled 921 compared to 708 in the same period last year, an increase of 30%.

-

Since the last week in April, the Pending volume has been 74% higher than a year ago. For the week ending 9/6, since we did not have a holiday until the 7th, new Pendings were 62% higher (99 vs. 61) than in the same week in 2019.

- We're also back on a volcanic pace for Closings. In each of the most recent twelve weeks, closing totals exceeded those of the same week a year earlier. In the past twelve weeks, we closed 810 transactions, up from 586 the year before (38% higher). Year to date, we passed last year's total by 34.

-

Inventory hit another eight-year low mark this week at 1,547. Only one time in the past eight years was the September inventory below the 2,000 level (in 2017). So for the first time in history, there is an urgency in $1,000,000+ property in Park City.

Key points: Updated 9/17/2020

The market is moving faster than we've ever seen it. If homes in any price range are priced well, they are going under contract quickly. The more a buyer is rushed into buying a million-dollar property, the more likely the transaction will not stick together. We currently have 15 properties under contract. As with anything else in life, I need to educate potential Park City buyers so they can move quickly and confidently when placing an offer on a property.

The Most Recent Real Estate Highlights:

-

New listings in the Park City area totaled 102 properties, compared to 100 for the same week a year ago. New listings of residential properties year-to-date total 2,589 compared to 2,514 for the same period of 2019. The supply of new properties for sale is not meeting consumer demand.

-

This year's pending volume (in escrow) is 75% higher since 2019 when comparing the last week of April to today. This past week new Pendings were 65% higher (106 vs. 64) than in the same week in 2019.

- Closings are more vital than ever. For the past thirteen weeks, 2020 has been stronger every week than 2019. In those thirteen weeks, 900 properties have sold, up from 638 the last year (41% higher). When reviewing the year to date, we passed last year's total by 72.

-

Inventory continues to fall and hit another eight-year low mark this week at 1,468. However, there are still beautiful homes and properties for sale. We have worked with several clients who love the property's bones but plan on a significant remodel with our preferred contractor and designer. In the past eight years, September inventory was below the 2,000 level (that happened in 2017).

Key points: Updated 9/24/2020

The real estate market continues to roll strong but it feels like it's beginning to "normalize." When I say normalize, I mean more like a busy summer season. That could also be attributed to the that I haven't been able to follow up with potential buyers because we are seeing a high number of showings on our listings, around $4,000,000. This week I pushed the total number of residences under contract to sixteen.

The Most Recent Real Estate Highlights:

-

New listings now total 2,715 for this year compared to 2,623 last year. In five of the past six weeks, we've topped over 100 new listings, and this week 125 residential properties hit the Park City MLS.

-

Pended contracts have been over 100 properties for ten consecutive weeks. This past week 117 properties went into escrow compared to 52 last year. A quick note is that there is an unknown number of new development properties under contract. While it may seem that Park City is "sold out" of real estate, many of my buyers are finding excellent properties, but there is less selection. Does less of a selection make it easier to choose a property?

- Closings for 2020 have caught up to 2019. Several months ago, I mentioned that we'd look at the number of properties that have sold in the Park City area at the end of the year, and we wouldn't be able to tell. We hit that spot in September with 1,411 closings, and to this point in 2019, there were 1,330 closings. This past week there were 87 closings which are 50% higher than the 55 that closed in 2019.

-

Inventory continues to fall and hit another eight-year low mark this week at 1,388. Compared to last week, we've dropped another 80 listings, but my clients are finding excellent properties to buy. I've been doing extra work uncovering off-market properties or finding properties before they hit the market. I also like being aggressive on the older listings that haven't sold yet.

- Golf properties in the Park City Area and The Canyons Village are incredibly hot.

- The Park City luxury home market is highly active! There are still some excellent properties for sale now, and there is an urgency for luxury real estate buyers.

Key points: Update 10/24/2020

The market remains more robust than in a typical year. The market is cooling off slightly, but it's still hotter than usual. So if you've been following a specific property for a while, don't be surprised if it sells as inventory gets tighter and tighter.

The Most Recent Real Estate Highlights:

-

New listings now total 3,070 for this year compared to 2,967 last year. However, we haven't seen over 100 new listings since the week of September 16, 2020.

-

Pended contracts have started to slow since the beginning of October. In each week of October, we have 84, 82, & 47 new pended properties. It should be noted that we aren't sure how many new construction reservations there are.

- Closings are up 15% this year. Up to October 24, we have seen 2,145 closings compared to 1,865 last year.

Key points: Update 11/13/2020

The Park City real estate market has been running strong, but we are cooling off starting into the offseason. Typically, home sales deceleration and condos are in a holding pattern around this time of year before ski season.

The 2020 graphs are now charting the same patterns as an average year but with higher numbers outside of new listings. So there's a decent possibility that the lack of supply turns into a demand problem.

New listings have been significantly lowered this year than last for the past two weeks. Contracts appear to be holding together with the relaxation in the market and giving buyers a bit of time to think about their purchase.

We are right around 1,100 listings in terms of inventory - last year, we had closer to 2,000 properties for sale in the Park City area. If we don't see new properties listed for sale, we can expect fewer than 1,000 properties to be on the market at the beginning of December. If you know of anyone looking to sell their property in Park City, please let me know - we have the best pipeline to buyers throughout the nation.

Park City Real Estate Trends During COVID in Graphs: Updated to 8/1/2020

Below you can review three graphs of new listings, a chart of the number of properties that have gone under contract, and the number of closings.

The blue line on the graph is 2019, while the red/orange lines are 2020.

Key points: Updated from 8/24/2020

We have been seeing the Park City real estate market function similar to last year in recent weeks. Primary indicators continue to point in the right direction.

The Most Recent Real Estate Highlights:

-

New listings continued their solid performance. Residential new listings in the past seven weeks totaled 645 compared to 496 in the same period last year, an increase of 30%. There is some excellent inventory on the market.

-

The pending volume for the past four months is 69% higher than the same period ago. In addition, for the fifth week in a row, new Pendings were more than twice-count from the same week in 2019.

- Pending contracts hit parity with 2019 the week of April 26. They tracked in unison for five weeks. Then all heck broke loose, and contract writers have been on a tear ever since. This past week set a year-to-date record with 78 more contracts (117 vs. 45) written than last year's same week. Pendings (homes going under contract) are perhaps the best leading indicator of market demand from the buyer side. And our buy-side is strong and getting stronger. After a bottom in mid-April, in the seventeen weeks since, Pendings in 2020 total 1393 compared to 825 in 2019, a 69% increase in pending volume.

-

In eight of the last nine weeks, closing totals exceeded those of the same week a year earlier. (One week was a tie.) In the past nine weeks, we closed 543 transactions, up from 435 the year before (25% higher).

New Pending (In Escrow) & Sold Properties:

In weeks 13-15, March 2020, the number of pending sales was dramatically less than in 2019. Since week 15, we have seen an upward trend in pending listings, where 2020 has outpaced 2019 in three of the last four weeks. The most recent week had one fewer pending sales than in 2019 - this could be the best leading indicator of the direction of the Park City real estate market.

By mid-June, the total inventory was up 12% at 2,030 listings (all types), the highest since October '19 (2,057).

Properties sold in the Park City MLS are trailing pending sales by thirty to forty-five days. Realtors are busy, but I'm never too busy to help. Don't hesitate to contact me if you are interested in previewing Park City real estate.

Data for Pending Property Sales on the Park City MLS for 2019 vs. 2020 During the Same Timeframe.

| Wk | Pend 2019 | Pend 2020 | Δ | Sold 2019 | Sold 2020 | Δ | |

| 1 | 25 | 24 | -1 | 15 | 10 | -5 | |

| 2 | 22 | 42 | 20 | 23 | 60 | 37 | |

| 3 | 33 | 47 | 14 | 32 | 38 | 6 | |

| 4 | 40 | 59 | 19 | 21 | 33 | 12 | |

| 5 | 81 | 44 | -37 | 38 | 29 | -9 | |

| 6 | 64 | 34 | -30 | 24 | 36 | 12 | |

| 7 | 46 | 35 | -11 | 35 | 32 | -3 | |

| 8 | 55 | 49 | -6 | 27 | 39 | 12 | |

| 9 | 44 | 42 | -2 | 59 | 32 | -27 | |

| 10 | 47 | 49 | 2 | 32 | 37 | 5 | |

| 11 | 53 | 42 | -11 | 40 | 27 | -13 | |

| 12 | 48 | 30 | -18 | 32 | 29 | -3 | |

| 13 | 40 | 20 | -20 | 38 | 26 | -12 | |

| 14 | 48 | 21 | -27 | 38 | 44 | 6 | |

| 15 | 46 | 19 | -27 | 43 | 30 | -13 | |

| 16 | 51 | 27 | -24 | 49 | 28 | -21 | |

| 17 | 34 | 35 | 1 | 40 | 19 | -21 | |

| 18 | 37 | 41 | 4 | 51 | 18 | -33 | |

| 19 | 42 | 44 | 2 | 31 | 21 | -10 | |

| 20 | 56 | 55 | -1 | 51 | 21 | -30 | |

| 21 | 54 | 61 | 7 | 52 | 19 | -33 | |

| 22 | 35 | 56 | 21 | 61 | 19 | -42 | |

| 23 | 34 | 61 | 27 | 33 | 30 | -3 | |

| 24 | 45 | 82 | 37 | 46 | 35 | -11 | |

| 1080 | 1019 | -61 | 911 | 712 | -199 |

Editor's Note: Editor's Note: This post has been back-dated to keep historical data or Park City Real Estate Trends throughout the Park City Real Estate Boom of 2020 to 2022. The most recent Park City Real Estate Trends update can be found here. On January 31, 2024, a section was added to link to additional years for Park City Market Trends.

Posted by Derrik Carlson on

Leave A Comment