Executive Summary - Updated for 2024: Explore Park City, Utah's real estate investment opportunities, from short-term rentals near top ski resorts to unique options. Discover strategies, considerations, and insights for successful property investments in this vibrant market.

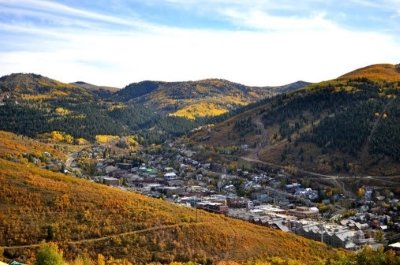

Learn About Investing in Park City, Utah, Real Estate

Investing in Park City, UT, real estate is one of the oldest and most popular asset classes for the wealthy and wise. Most new investors in Park City have multiple properties in different areas of the United States or the World and rent them short-term with light personal use. It is common for investors and developers in other areas of the United States to purchase properties in Park City.

Investing in Park City, UT, real estate is one of the oldest and most popular asset classes for the wealthy and wise. Most new investors in Park City have multiple properties in different areas of the United States or the World and rent them short-term with light personal use. It is common for investors and developers in other areas of the United States to purchase properties in Park City.

Below, we will discuss the different types of real estate investments, and you'll learn more about Park City real estate investing.

The Best Short-Term Rental areas in Park City

Searching for Park City investment properties usually starts around Park City Mountain Resort (Old Town), Deer Valley Resort Area, and The Canyons Village. Many of these areas allow for short-term rentals, also known as nightly rentals, and the best chance for the highest return on investment via rental income.

There is a premium when purchasing and renting ski-in-ski-out properties, allowing investors to maximize profits during the peak ski season. Old Town also allows property owners to receive higher rents during the Sundance Film Festival. In my experience, many of the owners in Deer Valley do not rent their properties on a short-term or long-term basis. Still, sometimes, they may offset some of their ownership costs by renting their property during the peak times of Christmas, New Year, and Presidents Day.

Great Opportunity to Buy a Deer Valley Investment Property

Pioche Village are newly built condos, one of our preferred investment properties in Park City, Utah, owing to its exceptional advantages. Its prime location offers access to the Deer Valley Resort Ski area, making it a dream come true for ski enthusiasts and investors alike. Additionally, Pioche Village presents an attractive price point, aligning perfectly with investment goals.

This community offers not only an exceptional opportunity for investors but also a chance to experience the allure of Park City and the epic expansion of Deer Valley Resort. With modern amenities and a seamless mountain experience at your doorstep, Pioche Village represents a unique investment opportunity in the heart of Park City.

Long-Term vs. Short-Term Rentals in Park City, Utah

For the past decade, Park City has needed long-term rentals. The most significant long-term benefit to leasing your property is that you'll receive a tax break and possibly less wear and tear. We have had clients rent their property for six months while staying in the property, typically in the winter and spending the summer months in Park City.

Every scenario will always be different, but your returns should be pretty even when comparing long-term and short-term rentals. As a Park City investment property owner, you will have more management company options for short-term rentals.

Finding Short-Term Rentals for Sale in Park City, Utah: A Simple Solution

Discovering the perfect short-term rental for sale in Park City, Utah, is seamless with our intuitive Map Search feature. Begin by navigating to the map search page on our website. You'll find a green "Filter" button to streamline your search. Click it to reveal various options, including the "Nightly Rental" category. By selecting this option from the drop-down menu, you can effortlessly search for properties available for nightly rental.

This powerful tool allows you to pinpoint your ideal price range and property type and offers the flexibility to filter by specific features such as location. Finding your dream investment property in Park City has never been easier.

Read more about Why Park City and Deer Valley Are the Best Places to Invest in Luxury Real Estate.

Park City Investment Realtors

Investment properties in Park City, Utah, aren't about cash flow. Instead, the typical goal is to use the property two to six weeks a year and have the nightly rentals cover the cost of ownership.

Investment properties in Park City, Utah, aren't about cash flow. Instead, the typical goal is to use the property two to six weeks a year and have the nightly rentals cover the cost of ownership.

My real estate strategies work great for buying investment properties in All of Park City. Every deal is different; sometimes, it's about getting the best value, while in others, it's about getting the deal on a property.

Park City and Deer Valley are challenging real estate markets with plenty of agents trying to compete for your business. I don't care if it's on an entry-level or luxury property.

The advice an agent offers is essential. It can be the difference between saving thousands of dollars or, in a hot real estate market, it could mean getting the deal or going home empty-handed. I try to advise my clients as I would a family member but also ensure that I have the best tools and resources.

If you don't like the property, we move on, but if you want the property, I have all the resources to remove any excuse for not buying. We can come in aggressive on the price; I have a great contractor and designer I work with that will make it easy for you. I've used them, so I know how giving a few Pinterest photos will help; we work with the best property management companies in Park City.

I aim to ensure you are comfortable searching for your new Park City property when we are under contract. I want to earn your business for a lifetime and help everyone you know buy and sell real estate in Park City. You'll quickly see you are in the best hands when buying or selling real estate in Park City, Utah.

Do Park City Investment Properties Cash Flow?

The truth is, rental properties in Park City, Utah, tend to be cash flow neutral when you pay cash. I generally tell people that if there is no financing for a nightly rental property, you typically cover the expenses at the end of the year.

Unfortunately, with the current demand for real estate in Park City, it feels as though the rental market hasn't kept up with property values. Yes, rental rates are increasing, but they are often a lagging indicator because rentals may have been booked twelve months ago. In the past, most investors have used projections balanced with historical numbers to develop their cash flow projections.

The typical buyer is searching for real estate that can be used for two to six weeks of the year and has a full-time property management company take care of the rest. Every year, hundreds of buyers purchase properties in Park City that break even, and over time, the rental numbers increase, and the property appreciates.

In a previous comment on this blog, Ron asked, "When you say "cover all bills" does that include the mortgage?" To answer the question, the break-even does not include the cost of covering the mortgage. Recently, a client asked me to research rental numbers on several properties, and we could not find a property to cover the cost of a mortgage with 20% down. In addition, unless you know your mortgage rate, we won't be able to calculate the mortgage cost.

Ski-in-ski-out properties at Park City Mountain, The Canyons, and Deer Valley tend to offer 120 to 150 peak days a year of peak days for the rental market. Many factors play into the rentability of a property in a resort town.

Non-Traditional Ways to Invest in Park City Real Estate

Discover two unique investment approaches in Park City real estate. First, the New Construction and Spec Home Strategy offers the potential for higher returns but with increased risk.

Option One: New Construction Investments Upcoming new construction projects present an opportunity. Historically, early investors in such projects have seen success, selling properties upon completion. Benefits include a potential two-year break from mortgage, taxes, and HOA fees, with the chance to control 80% of the property with just 20% down. However, market fluctuations can increase the risk, potentially requiring extra investment at closing.

Option Two: Speculative Home Building Building speculative homes in Park City can be financially rewarding but require more effort. This involves securing land and hiring architects, builders, and designers. The potential upside includes market arbitrage and capitalizing on rising property values. The challenges include higher initial capital, extensive planning, and market volatility risks.

Both options carry risks like loan program changes, construction uncertainties, and market shifts. Consider these strategies carefully, weighing their potential against your investment goals and market conditions.

Check out when the best time of year is to buy a condo in Park City!

The Different Types of Investment and Rental Properties in Deer Valley and Park City, Ut

The Park City MLS allows properties to be classified in seven ways. The general rule of thumb for finding a great investment property is that the closer you are to the resorts, the higher your gross rental revenue. However, as Park City has grown, it is worthwhile to consider the Jordanelle area as an investment property. The areas around the Jordanelle may be a little more restrictive for nightly rentals, but with Mayflower Mountain Resort, there is an upside for appreciation.

The nightly rental number is only as accurate as the listing agent puts the information into the MLS - search all properties, and if you have any questions, feel free to contact me to discuss the options.

Homes: When investing in Park City homes for sale, it should be noted that they may or may not allow for short-term rentals. The location and proximity to the ski resort will play a significant role in the property value and rental possibilities. If you would like to double-check if a home can be rented for nightly rentals, here's a map for Park City Nightly Rentals.

Condos: Condos for sale can be found throughout Park City. The homeowner association fees start at around $350 per month and increase to over $50,000 per year. The HOA fees will be subtracted from your gross revenue, so paying attention to the fees when considering purchasing a Park City condo is essential. The HOA can also add value to the property by keeping it in good condition and providing additional amenities, making renting easier.

Townhouse: Townhomes can stand alone in your real estate search but are pulled in within the condo search. Townhomes tend to be larger than condos and possibly live more like single-family homes.

Vacant Land: If you are considering purchasing land for sale in Park City, you will be looking for appreciation. This speculative play may reap significant rewards, but you will not have rental income during your time of ownership. There is also a possibility that the land has HOA fees, typically lower than a property with a home, but HOA fees are worth considering.

Commercial: Commercial real estate in Park City tends to be office buildings. In Park City, commercial real estate is marketed much like our luxury properties. Many of the properties for sale will be on the Park City MLS and this website. I strictly work in residential real estate, but I have several commercial real estate agents who can help provide the professional service you're looking for when buying commercial property.

Fractional: Fractional ownership is structured much like a timeshare, but you own the property, not a piece of paper. While some investors prefer fractional ownership, I tend to shy away from the property type because of its lack of liquidity and weak appreciation. Instead, I'd rather have full ownership rights of a smaller condo and more control over when I'm able to rent or use the property.

Multi-Unit: This is a new property type in the Park City MLS, which allows you to search by "stacked product." Multi-unit means multiple residences on multiple floors. This should not be confused with multi-family properties like a duplex or triplex. Contact me if you're searching for a multi-family property in Park City, as the search can be pretty complicated.

Management Companies for Your Park City Investment Property

Most buyers looking for rental properties in Park City are interested in short-term rentals. Local property management companies charge 25% to 50% of the gross rental income. I tend to shy away from the higher-priced property managers because some great companies charge less, improving your bottom line. Most Park City property owners who rent their property pay 25%-35% for full property management services and are entirely hands-off with management.

5 Ways to Value Investment Properties in Park City, Utah

Items to Consider When Buying Park City Investment Properties

Much of my business is from second homeowners and investors. Park City investors are looking for a turn-key vacation rental where they can own it from another state and not worry about issues that may arise.

Much of my business is from second homeowners and investors. Park City investors are looking for a turn-key vacation rental where they can own it from another state and not worry about issues that may arise.

When you work with me, you'll have all the tools you need for an easy remodel, designers, property management, and a complete overview of the Park City real estate market. Discover How to Value Investment Properties in Park City & Deer Valley.

Derrik Carlson has owned, managed, and raised financing for many of his personal investment properties. Naturally, therefore, this information is reliable, but it is not, in any way, shape, or form, investment advice.

Editor's Note: Originally written by Derrik Carlson on March 29, 2020, this article received its most recent update on February 22, 2024. The purpose of this update is to provide a clear and comprehensive guide aimed at helping individuals find short-term rentals for sale in Park City, Utah. This revision is carefully crafted to ensure the information is accessible and valuable for those seeking to locate short-term rental properties in the area, adhering to SEO best practices for enhanced discoverability.

Investment is suitable for financially prepared individuals; agents cannot guarantee returns. Evaluate your goals, risk tolerance, and finances before investing.

Posted by Derrik Carlson on

We are interested in a 2nd home in Park City but would also want it to be an investment property maximizing short term rentals. We will be in Park City for a few days later this month and have been looking online but are not sure what areas do/do not allow short term rentals. Thanks

Posted by Penelope Boettiger on Monday, September 7th, 2020 at 4:49pmHi, looking for a good rental investment property sub $2mm. Goal would be to cover all bills, insurance and taxes and find a place where the appreciation would rise for when selling in future. Please let me know if you have any ideas. 2+ bed plus 2+ bath minimum.

Posted by Ron D. on Monday, March 15th, 2021 at 6:32pmTHANKS,

Ron

Hi Ron,

Posted by Derrik Carlson on Monday, March 15th, 2021 at 6:38pmWhen you say "cover all bills" does that include the mortgage?

Kindly, Derrik

Helpful guide that investors can follow through it for their property and real estate investment needs.

Posted by Revolve on Sunday, November 6th, 2022 at 10:18pmInterested in buying a vacation rental property in the next 6 months

Posted by Ashley B on Monday, December 26th, 2022 at 11:10pmLooking for local expertise since we are out of state. Pennsylvania

It's really important to know these ideas for investors can refer through - save time and money.

Posted by Clarence Presley on Wednesday, May 24th, 2023 at 7:47pmLeave A Comment