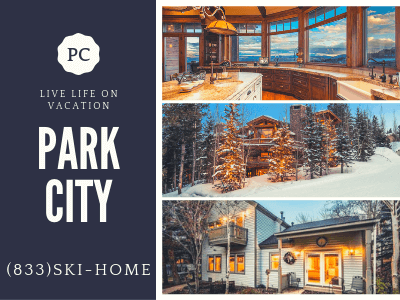

Understanding The Real Estate Market of Park City, Utah

Our goal with every client is to provide unsurpassed service and knowledge when buying and selling real estate in Park City and Deer Valley.

As we work together throughout buying your new property in Park City or Deer Valley, we believe it is essential to make the home-buying process as fun, convenient, and efficient as possible. Welcome to the crash course of buying Park City Real Estate.

How Much do Homes Cost in Park City, Ut?

The entry-level price point for Park City single-family homes starts at around $1,000,000 and can surpass the $40,000,000 price point. Studio condos may be in the $250,000 price range, while large luxury condos may exceed $10,000,000. When searching for homes online, you'll recognize that there is more value in homes priced over $3,000,000, townhomes over $1,400,000, and condos over $1,200,000.

What types of homes does Park City offer?

What types of homes does Park City offer?

Condo: When you buy a condo, you have full ownership and some of the building's common areas (gym, pool, playground). You have complete control if you want to rent or sell the property anytime. Condos are an excellent option for second homeowners looking for a turnkey property where the HOA controls the maintenance schedule.

HOA fees in Park City start at the $500/mo mark, and luxury condominiums in Park City work their way up over $5,000/mo - depending on what type of amenities you want. Typically the cost of ownership, especially around the ski resorts, can be offset by renting the property on a nightly basis.

Townhouse: A Park City townhouse is typically a three+ story building that may or may not be attached to another building. It may serve as a single-family home or a condominium. While townhouses are closer together than single-family homes, they usually have backyards. In addition, they are more vertical in living than on a different floor than in a condominium.

Townhouses tend to be valued higher than condominiums and provide the same turnkey lifestyle but live more in line with a single-family home. Depending on the subdivision, townhomes may be classified as homes or condos on the Park City MLS.

Fully detached single-family home: Single-family homes in Park City come in all different shapes and sizes. In Old Town, it is common to find a home smaller than 1,000 square feet, while in areas such as The Colony at White Pine, homes are 33,000 square feet. Outside of Old Town, homes are often larger and more spacious than condominiums and provide the full benefits of homeownership. Many areas of town don't allow for nightly rentals of single-family homes.

Is it Better to Rent or Buy in this Ski Town?

I've worked with several buyers who started living in Park City by renting a place and taking time to understand where they want to live long-term. If you're planning on living the Park City lifestyle, that may work best for you, but with a few hours of touring Park City, we can narrow down the areas that will work best for you. Some people in Park City have chosen to purchase a smaller property to get their foot in the door and, after several years, step up to a larger property that will work well for living in Park City year-round. Ultimately, it's what works best for you!

Should I Hire a Real Estate Broker When Buying in Park City?

You can buy a property in Park City without a Realtor, but you'll be at a disadvantage. The listing Agent works for the Seller, and their duties are to maximize the profit for the Seller, much like the board of a publically traded company. Many great agents in Park City have been in the market for a long time and understand the market very well. We are skilled in negotiation, the direction of the market, and how to make the best deal for our clients.

Should I get Pre-Approved?

If you need financing, the answer is Yes, Yes, and Yes! A pre-approval letter usually takes a twenty-minute phone call with a lender and can be provided to the Seller with the purchase contract. If you're paying cash, be prepared to supply proof of funds when we go under contract. We want you to look as strong as possible for the negotiations when submitting an offer to purchase Park City real estate.

To get a great price on a property, it is vital to show you come from a position of strength and can make the transaction as easy as possible for the Seller. No one wants to go under contract and start the moving process to find out the buyer can't purchase the property.

When can I Move Into a Property I'm buying?

Possession of a property, or when you can move in, is negotiated in the purchase contract. If the property is not occupied as a full-time residence, you'll most likely be able to move in after funding and recording. If someone lives on the property, we typically ask for 72 hours until possession occurs. Seventy-two hours gives the sellers time to ensure that the closing takes place, money is in their account, and everything is moved out.

Are You Ready to Buy a Park City Property?

Here's our process of buying real estate in Park City.

- Maintain continuous communication.

- Carefully analyze your needs and remain sensitive to your unique requirements.

- Orient you to current market conditions.

- Provide valuable community data.

- Explain local real estate practices and procedures.

- Provide information on financing alternatives.

- Thoroughly analyze the entire inventory of homes on the market.

- Provide information on selected properties that meet your needs.

- Avoid wasting everyone's time.

- Professionally show selected properties.

- Explain the process of offering a presentation.

- Carefully review the offer to purchase.

- Conscientiously facilitate the negotiations.

- Explain post-purchase activities and responsibilities.

- Follow up on post-purchase activities.

- Keep in touch after closing.

Our job is to help make your dream of buying a Park City property come true!

Advantages of Working with The Carlson Real Estate Team To Buy a Home

Buying a home in the Park City area is often a longtime goal and one of the most rewarding experiences most of us will ever have . . . without the proper knowledge; it can also be one of the most challenging. If you haven't purchased a property in a while, the online research process may seem overwhelming; and even if you've been through it dozens of times, every move is different and presents new challenges. So, one clear advantage of enlisting our help is that you don't have to "go it alone."

I have the training, knowledge, and experience to help you through each step of the process. That means we know the process of buying Park City real estate, and we are here to help you every step, ensuring that every detail is handled correctly. We like finding, buying, and having you move into your new home as smoothly, quickly, and enjoyable as possible. In addition, we can provide a valuable source of information about market trends, communities, neighborhoods, and especially homes for sale throughout the Park City area. Remember, not every home seller runs an online ad, puts in the local paper, or places a yard sign.

We can offer you access to complete, regularly updated information about every home listed by every broker on the Park City Multiple Listing Service (MLS). My combination of unique skills ensures a smooth process every step of the way.

Buying a Property in Park City

Buying a house or condo can be confusing at times. There can be many directions and options for where you want to be in Park City. For example, do you golf, would you like to be close to skiing, how far away from the airport is acceptable, what amenities would you like to have, and so on?

I can often take a client looking at properties in Park City for years and have their search narrowed down within two hours - we are here to help. We can show you properties that any broker in Utah has listed for sale. Full-service real estate means all you have to do is call me at 435-200-5478 for all the information you need.

- Would you like to see a property you found online: RealEstateInParkCity.com, Realtor, Zillow, etc.?

- See a real estate sign

- Read about a house in the paper or magazine

- Hear about a property

- Want to preview a property

- Want more information or to preview new construction?

- By having me represent you with a builder, you get all our services and those offered by the builder without paying more. The builder is paying for you to have representation - the project agent only protects the builder's interest.

The Process of Buying a Park City or Deer Valley Home or Condo:

Purchase Contract (Offer and Acceptance)

In negotiating the purchase of your new Utah property, the initial step will be to make an offer to purchase. This is required to be written and will include the following:

- The amount you are willing to pay,

- Financing terms,

- Any personal property specifically included or excluded,

- Loan commitment date or possibly proof of funds,

- Closing and occupancy date,

- Other contingencies and dates, including inspections.

The offer will be written on a standard real estate purchase contract approved by the State of Utah. If the Seller does not accept the initial offer, we'll continue negotiating until agreeable terms to both the buyer and Seller are reached. When both agree on the terms, the buyer completes financing and arranges for inspections. We will provide a list of lenders and local inspectors best suited for your situation.

Earnest Money Deposit for Park City real estate:

After a fully executed contract, you will submit a check or wire transfer to my brokerage to hold the earnest money. The amount deposited will be kept in a non-interest-bearing trust account. This money represents your sincerity in the attempt to purchase and is fully refundable if the contract is canceled before contract deadlines which would include financing and appraisal, if your loan is not approved, or if the Seller does not meet the conditions of the contract.

The standard amount of earnest money for a Park City real estate transaction is 3% to 5%. This earnest money will be credited to you at closing as part of your down payment or funds to close.

Title Insurance on Park City and Deer Valley Properties:

When a property is sold or refinanced, the lender and/or buyer needs a preliminary title report to determine what liens and encumbrances are against the property. The property seller pays for the buyer's title insurance policy, and the buyer pays for the lender's policy. If you are paying cash when purchasing a Park City home or condo, the title fees are inexpensive since the Seller is paying for your policy.

Items that a preliminary title report includes:

- Easements of record,

- Restrictions, covenants, and conditions (CC&Rs),

- HOA minutes and budge

- Liens and/or judgments,

- Exact vested owner of record, and

- Legal description.

When the sale of the subject property is final, and the title company has recorded the necessary documents, they will issue a policy of title insurance to the new lender and the buyer showing clear title to the property.

Understanding Real Estate Brokerage Relationships With Your Park City Realtor

An explanation of who represents you.

In real estate, brokers and agents are required to disclose the type of working relationship they have with the buyers in a real estate transaction. Several types of relationships are available to you. It would be best if you understood these relationships when a broker provides specific assistance to you in buying real estate.

Buyer's Agent and Seller's Agent relationships are commonly referred to as "agency" relationships and carry with their legal duties and responsibilities for the broker and the buyer and Seller. For example, the Transaction Broker relationship places the broker as a "middleman" who assists both parties in the transaction. A buyer is advised to consult legal counsel before entering into any agency relationship.

Buyer's Agent

A Buyer's Agent acts solely on behalf of the buyer and owes duties to the buyer, including the utmost good faith, loyalty, and fidelity. The Agent will negotiate on behalf of and advocate for the buyer. The buyer is legally responsible for the actions of the Agent when that Agent is acting within the scope of the agency.

The Agent must disclose to sellers all adverse material facts concerning the buyer's financial ability to perform the terms of the transaction and whether the buyer intends to occupy the property. In addition, a separate written buyer's agreement is required, which sets forth the duties and obligations of the parties.

Seller's Agent

A Seller's Agent acts solely on behalf of the Seller and owes duties to the Seller, including the utmost good faith, loyalty, and fidelity. The Agent will negotiate on behalf of and act as an advocate for the Seller. The Seller is legally responsible for the actions of the Agent when that Agent is acting within the scope of the agency. The Agent must disclose to buyers or tenants all adverse material facts about the property known by the Agent. A separate written listing agreement is required, which sets forth the duties and obligations of the parties.

Transaction Broker

A Transaction Broker assists the buyer or Seller or both throughout a real estate transaction with communication, advice, negotiation, contracting, and closing without being an agent or advocate for any of the parties. Therefore, a Transaction Broker does not owe the duties of a Buyer's Agent or Seller's Agent to either the buyer or the Seller. However, a Transaction Broker does owe the parties several statutory obligations and responsibilities, including using reasonable skill and care in performing any oral or written agreements.

A Transaction Broker must also make the same disclosures as agents about adverse material facts concerning a property or a buyer's financial ability to perform the terms of a transaction. When representing a seller, we require the buyer to either have a buyer's Agent or to sign a form stating they are unrepresented. We do this because, from my understanding, 70% of all real estate lawsuits involve a Transaction Broker.

Using an Agent to Purchase a Newly Built Home or Condo in Park City and Deer Valley:

You might be asking - why should I use an Agent to purchase a new home? The advantages of having me help you buy a new home are the same as those for purchasing a resale home. We can provide valuable insight into the market, find the perfect fit quickly, and provide you with expertise in contract writing, negotiation, and closing assistance.

The builder has a professional real estate representative watching out for their interests, and you deserve professional representation watching out for your interests.

Buying a new home is a little more complicated and time-consuming than buying a resale. Having spent years working with builders, we have built rapport with the builders and their agents, allowing me to negotiate a better deal for you. In addition, we can provide you with more information that the builder will supply regarding sold data, future development in the area that might affect your property's value, floor plans, and other options that might work well for you at a better value.

We guide the builder's purchase contracts that protect the builder rather than the buyer. Your interests must be professionally represented when entering into a contract for a semi-custom or a build-to-suit home. These transactions are complex, and the contract details must be exact to protect you and ensure you get exactly the home you want!

Is there any advantage to not using an Agent to purchase new construction?

No. There is no financial advantage for you to buy directly from the builder. A real estate broker usually represents builders, the listing agreement and compensation have already been predetermined, and the listing contract signed. This is referred to as a "single-price" policy, meaning you will be charged the same price whether an Agent represents your interests. Just as in any resale, the Seller pays your Buyer's Agent.

Item to note: Some builders require your Agent to accompany you on your first visit to the builder's sales office, or they will not pay your representative's fee leaving you with no representation.

Quick story: Derrik recently helped navigate getting a new construction home under contract while many other buyers were left in line. In a new development, only a handful of highly desirable homes were released every few weeks with a waiting line. As a result, we were able to position the client where we were able to get under contract and save her $30,000 from what she originally budgeted.

During the Property Search, we will . . .

- Discuss the benefits and drawbacks of each property concerning your specific needs.

- Keep you informed regularly.

- Check the MLS database with other brokers daily for new listings that meet your criteria.

- Prepare an itinerary and "tour" map on which all homes meeting your criteria have been located.

- Keep you up to date on changing financial conditions that may affect the housing market.

- Be available to answer your questions or offer assistance regarding your home purchase.

- Discuss market trends and values relative to properties that may interest you.

- Introduce you to local builders to discuss building your next home.

Viewing Park City and Deer Valley Homes & Condos

After our initial counseling appointment, we will have a good idea of your wants, needs, price range, and location. We will use the Park City MLS and the Wasatch Front MLS to find homes and condos currently for sale. We will discuss what properties will work best for you and make arrangements to show you the best homes or condos within your budget. Remember to wear shoes that are easy to slip on and off when viewing properties. Feel free to open the cabinets and closets as you walk through the homes.

Most often, the sellers will be absent, but should they be present, they will understand your need to examine the home carefully. When a home appeals to you, make notes. It is easy to forget details, so we suggest you make a name for each property we preview. Don't be surprised if the first property you see is the perfect one for you, and don't be discouraged if none of those you visit the first day are exactly what you want. We are committed to finding the one property you want to call "home" and will work diligently until you find it. More often than not, we can see the home of your dreams rather quickly and will find 3- 5 houses that best fit the desires you expressed.

After the Search for Your Park City Home or Condo

- You will be provided with any information you may request to help you decide on a property you wish to purchase. We will be your resource for providing information. Please let me know what information you need.

- Prepare an offer to purchase agreement and explain each detail.

- Provide copies of all the documents involved in the purchase agreement and financing.

- Make arrangements with a loan officer and accompany you to the loan application if you haven't done it earlier.

- Coordinate any necessary inspections of the property to evaluate the property and negotiate the results of the inspection.

- Track the step-by-step process of completing the terms of the contract.

After Finding Your Home or Condo: Understanding Closing Costs

- Application Fee: ......................... The lender charges the fee to pay for the fixed costs related to mortgage loan processing, such as appraisal, credit report, and underwriting.

- Closing Fee: ............................... The title agent who prepares the closing documents and closes the loan on behalf of the lender charges the fee.

- Commitment Fee: ....................... This is often called an origination fee and is generally computed at 1% of the mortgage or an amount the lender charges.

- Discount Points:......................... Each point is equal to 1% of the mortgage amount. The lender uses points to adjust the yield on the mortgage when it is sold to an investor. Therefore, the borrower can obtain a lower mortgage interest rate by paying more points.

- Funding Fees: ............................ Ordinarily applicable to VA loans only, equal to a percentage of the loan amount. The fee is due at closing or may be added to the loan amount and financed.

- Homeowner's Insurance:............ A one-year premium is due in advance of the time of closing.

- Mortgage Insurance:................... Insurance is required by the lender when the down payment is less than 20%. In the case of loan default, this insurance reduces the lender's loss.

- Pre-Payables: ............................. Adjustment to escrow accounts from closing to the date of the first payment. Interest is paid through the end of the month of closing; taxes are paid through the end of the month of closing, plus the following month. Two months of PMI may be collected. In addition, two months of homeowner's insurance may be collected. A homeowner's insurance policy and a receipt showing that the first year's premium is paid must be provided.

- Processing Fee:........................... Fees charged by the escrow processor (either working for the escrow company, title company, or real estate company) for administrative escrow services performed from the point of contact through closing.

- Recording Fees: ......................... State and municipal entities charge fees for entering the closing documents into the public record.

- Survey Fee: ................................ The lender usually requires and uses the fee to check for encroachments from within or outside the subject property.

- Title Insurance:........................... Protects lenders and homeowners against financial loss resulting from legal defects in the title.

- Underwriting Fee:...................... The fee is usually included in the application, although practices vary from lender to lender.

Flood Certification Fee: ............ The lender must determine if the home requires flood insurance. - Tax Service Fee:......................... A one-time charge collected at closing arranges the payment of real estate taxes from the borrower's escrow account to the taxing authority or verifies payment to the taxing authority.

I've been involved with selling real estate in Utah since 2004 and have come to rely on a group of professionals that we feel are best suited for a specific need. Approximately 50% of Park City buyers pay cash, but if you're searching for financing, we typically refer two or three lenders that will be best suited based on your needs and the property type. For example, a particular lender will sometimes be better suited for a Deer Valley condo.

At the same time, another will be able to provide you with a better option for a Park City single-family home. There are plenty of home inspectors that are licensed to inspect properties, but we have one particular inspector that is the best we have worked with, and he does the inspections for my buyers a majority of the time.

Suppose you have a lender you love to work with. In that case, it is acceptable to use them when purchasing property in Park City. However, we ask that they understand the type of property you will be purchasing, the HOA nuances, and the nightly rental aspect of Park City. When working with us, we will refer you to the best of the best and only people we would work with ourselves. Working with true professionals has allowed my buyers to have smoother transactions and a great experience.

Similar Pages:

- How to buy a property in Park City, Utah, if you live out of the country.

- Find out more about Keller Williams in Park City, Utah - The world's largest international real estate brokerage.

- The Advantages of Working with Derrik Carlson

Have Any Real Estate Questions You Want Answered?

Editor's Note: The most recent update of this post was on January 18, 2023. This page was initially posted on https://www.realestateinparkcity.com/buyers-guide.php

Leave A Comment