Park City Real Estate Trends: A Detailed Analysis of 2023 (Historical)

Executive Summary: In 2023, Park City’s real estate market is making headlines—luxury homes are soaring to new heights while condos are selling almost overnight. Discover how rising prices, a discerning buyer pool, and limited inventory are shaping one of the nation’s most coveted mountain destinations. Stay tuned for insights into a market where every deal tells a story of high-end opportunity and lifestyle excellence.

In the picturesque landscape of Park City, Utah, the real estate market has shown both resilience and variability throughout 2023, navigating through a complex terrain of economic factors and consumer preferences. This analysis delves into the latest trends, offering insights for potential buyers, sellers, and investors alike. With a focus on single-family homes and condominiums within Park City Limits and the Snyderville Basin, we uncover the dynamics shaping the market today.

Historical Market Report for 2020, 2021, and 2022

In the introductory segment of our comprehensive report, we are excited to offer direct access to a meticulously curated historical data collection. This collection encompasses a detailed examination of the real estate landscape within the boundaries of Park City and the Snyderville Basin, covering an extensive period from 2020 to 2022, specifically within the zip codes 84060 and 84098. Our analysis is rooted in the authoritative statistics the Park City Board of Realtors provided, ensuring both accuracy and depth in our insights.

Our approach meticulously concentrates on the unique market dynamics of Park City and Deer Valley, setting us apart from the rest. Unlike other platforms and professionals who might amalgamate Park City's data with that of its neighboring areas, our focus remains undiluted, dedicated exclusively to these premier locations. This targeted approach underscores our commitment to serving buyers and sellers with precision and expertise in these highly sought-after regions.

We have organized our findings from previous years into a well-structured archive for an optimized and user-friendly experience. We invite you to explore our Historical Park City Real Estate Trends through the links provided below, each leading to an in-depth analysis of the market's evolution over the past three years.

- Current Market Trends

- 2024 Market Stats

- 2022 Park City Market Stats

- 2021 Park City Market Report

- 2020 Park City Real Estate Trends

Overview of Market Dynamics for 2023

A distinct dichotomy within the Park City real estate market has marked 2023. Interest rates, holding steady, have impacted buyers reliant on financing. This financial hurdle has particularly affected the lower end of the market, where small condos have faced challenges in attracting buyers. Conversely, the upper end of the market has continued to thrive, with large ski homes experiencing robust demand. Despite a slowdown in the golfing communities of Park City, properties in these areas are still finding their way to closing tables, underscoring the enduring appeal of Park City's lifestyle offerings.

Single Family Home Stats: Park City Limits & Snyderville Basin

2023 Real Estate Highlights for Park City, Utah

- Median Sales Price: Witnessed a significant increase to $3,000,000, marking a 23.5% rise from 2022. This uptick underscores a strong demand for quality living spaces in premium locations.

- Median Sales Price: Witnessed a significant increase to $3,000,000, marking a 23.5% rise from 2022. This uptick underscores a strong demand for quality living spaces in premium locations.

- Closed Sales: There was a downturn to 942 transactions, reflecting a 10.5% decrease from the previous year, indicating a market adjustment.

- Active Inventory: Slightly reduced to 209 listings, a 5.9% decrease from 2022, suggesting a tighter market with fewer options for buyers.

- Median Days on Market: Increased to 63 days, up 26% from 2022, indicating a more balanced market where buyers take additional time to make purchasing decisions.

- Median Sold Price Per Square Foot: Rose marginally to $788, a 1.8% increase from 2022, which points to a steady valuation in the face of changing market dynamics.

Condo Stats: Park City Limits & Snyderville Basin

2023 Highlights

- Median Sales Price: Because the upper end of the market is not as interest rate sensitive, it appears as though prices soared to $1,245,000, a substantial 34.6% increase from 2022, reflecting a heightened demand for condos amidst a competitive market.

- Closed Sales: Experienced a decline to 488, a 37% decrease, signaling a cooling phase in condo sales.

- Active Inventory: Marginally fell to 188, down 2.1% from the previous year, indicating a stable supply side.

- Median Days on Market: It was drastically reduced to 8 days, an 84.4% decrease from 2022, showcasing a rapid turnover rate for condos.

- Median Sold Price Per Square Foot: Jumped to $1,013, up 31.2% from the previous year, highlighting a strong consumer willingness to invest in premium condo properties.

Personalized Market Analysis

For those considering diving deeper into specific segments of the Park City real estate market, such as ski-in-ski-out homes or condos, we offer tailored market analyses to guide your decision-making process. Property owners curious about their home's current market value can also reach out for a personalized "What's My Home Worth?" assessment, leveraging our deep market knowledge to provide accurate evaluations.

Our Experience and Commitment

With 12 years of experience in the Park City real estate market, 2023 is our second-largest year in terms of volume. This milestone is a testament to our dedication and expertise in serving our clients. Whether you're contemplating buying or selling a home or condo in Park City, our team is eager to earn your business, offering unparalleled service and insights.

Conclusion for 2023 Park City Market Trends

The Park City real estate market in 2023 has been a landscape of contrasts, with prevailing interest rates shaping buyer segments differently. While challenges persist, especially at the market's lower end, the enduring appeal of luxury homes and condos continues to drive the market forward.

Our commitment to providing personalized, expert guidance remains unwavering as we navigate these trends, ensuring our clients are well-positioned to make informed real estate decisions in this dynamic market.

Big News for Park City for 2023

Some big things are happening in Park City. In 2022, Time magazine ranked it one of the 50 Best Places in the World.

- The Sundance Film Festival was back in town this year.

- It was reported that the Salt Lake International Airport was ranked #3 worldwide for on-time departures.

- The Deer Valley Resort area will expand into Mayflower Moutain Ski Resort with new construction opportunities for ski-in-ski-out homes, land parcels, and condos for sale, with the first lift running 2024/2025

- Lastly, the odds of Utah winning the big for the 2030/2034 Olympics have remained strong.

Park City Real Estate Trends: October 2023 Update

As we enter the final quarter of 2023, it's time to examine Park City, Utah's latest real estate trends. This month, we've combined data for Park City homes and condos, focusing solely on the Park City market for our update.

Key Insights for October 2023:

Park City's real estate market has shown intriguing shifts recently. The number of property listings has steadily decreased over the past four months, sliding from 469 in July to 424 in October. This trend coincides with a drop in the absorption rate, which has decreased from 6.57 months in July to 5.78 months in October. These changes indicate a tightening market with a dwindling supply of available properties.

Listing Prices and Transaction Activity:

Listing prices have remained relatively stable, with only slight fluctuations. Meanwhile, transaction activity has followed seasonal patterns. It's important to note that the ski resort opening might be an opportune time to explore ski property options.

As we've highlighted in previous updates, one-month snapshots can sometimes be influenced by unique property sales that skew the numbers. For example, six luxury home listings are currently priced over $25,000,000, typically with longer sales timelines than properties in lower price ranges.

Navigating the Complex Park City Market:

The Park City real estate market is a complex landscape. For instance, a 4+ bedroom home ranging from 4,000 to 5,000 square feet can vary widely in price, spanning from $1,750,000 to nearly $7,500,000. This range underscores the importance of understanding the nuances of the market, and our team is here to help you gain that insight.

October 2023 Market Highlights and Comparisons:

Absorption Rate: In October 2023, Park City recorded an impressive absorption rate of 4.41, marking a 255.65% increase compared to October 2022, but still under a six-month supply that is considered a healthy supply of properties.

List Prices: The average list price in October 2023 was $3,193,570, showing a modest decrease of 6.44% from the same month in the previous year. However, considering the year-to-date average list price of $3,068,793, we observe a healthy 4.04% increase throughout 2023, indicating resilience in property values.

Similarly, the median list price in October 2023 was $1,834,375, reflecting an 8.28% decrease compared to October 2022. Yet, the year-to-date median list price of $1,789,950 shows a 2.70% increase, suggesting consistent growth.

Sale Prices: The average sale price in October 2023 was $1,944,696, a 16.57% increase from October 2022. This impressive gain is mirrored in the year-to-date average sale price, which aligns with the October figure.

The median sale price in October 2023 was $1,488,234, an increase of 13.82% from the previous year. Once again, this upward trend is consistent with the year-to-date median sale price, indicating sustained appreciation in property values.

Days on Market: The average cumulative days on market (CDOM) for properties in Park City was 85 days in October 2023, reflecting a 34.92% increase compared to the same month in 2022. This uptick in CDOM may suggest a slightly longer wait for sellers.

The median CDOM in October 2023 was 56 days, showcasing an increase from the four days reported in October 2022. However, the year-to-date median CDOM remains at 63 days, indicating that properties are generally selling within a reasonable timeframe over the year.

Conclusion:

The real estate market in Park City, Utah, continues to be dynamic and appealing, especially for those looking to live life on vacation. The October 2023 data reveals notable changes compared to the previous year, with surges in the absorption rate and sale prices. While list prices have experienced some fluctuations, the year-to-date figures demonstrate overall growth.

As we move into 2023, it's important to closely monitor these trends and consult with local real estate experts to make well-informed decisions. Whether you're considering buying, selling, or investing in Park City, these insights offer valuable guidance for navigating this vibrant market.

Stay tuned for more updates on Park City real estate trends as we approach the end of the year. If you have any questions or are ready to explore the Park City market, please don't hesitate to reach out to us. We look forward to assisting you in achieving your real estate goals in Park City's diverse and dynamic real estate landscape.

The Carlson Real Estate Team Update - October 2023

As autumn leaves paint the landscapes of Park City, The Carlson Real Estate Team is setting a blazing trail in the real estate market. In the past 60 days alone, we've been at the heart of over $29,000,000 worth of real estate transactions in the Park City vicinity. From condo buyers to luxury property connoisseurs, our team has catered to a diverse clientele, facilitating deals ranging from $750,000 to $11,900,000.

Our momentum is palpable. We have continued to provide stellar service to our clients, and we're also on track to secure two of the top three highest-priced transactions in Park City for October 2023. This accomplishment is a testament to our team's expertise and underscores our unwavering commitment to finding the perfect match for our buyers and sellers.

With the ski season approaching, we'd like to highlight that the inventory for premium properties, particularly ski-in-ski-out gems, continues to be limited. The demand for these elite properties is robust, and our team is at the forefront, ensuring our clients can access the best the market offers.

To all our clients and partners, thank you for entrusting us with your real estate aspirations. Your success is our success, and we remain dedicated to illuminating your path to the perfect property.

Derrik Carlson

The Carlson Real Estate Team

September 2023 Statistics and Trends

Park City Home Trends - Sept 2023

The real estate landscape in Park City continues to evolve with a few surprising turns. As buyers and sellers adapt to this dynamic market, staying informed about the latest statistics and trends is crucial. Here's what September had in store for the single-family homes in Park City.

The Park City real estate market saw notable shifts in September 2023. The median home sales price decreased to $2,675,000, down 13% from the prior month and 6.1% year-over-year. Despite the price drop, home sales increased significantly, with 55 homes sold—an uptick of 37.5% from August. Homes stayed on the market for an average of 61 days, slightly longer than previous periods. Sellers secured about 97.4% of their asking price, a minor improvement from prior figures. Lastly, the inventory decreased substantially to 4.6 months, indicating a competitive market with high demand and limited supply.

-

Median Sales Price: In September, the median home sales price was $2,675,000. This represents a decrease of 13% from the previous month and a decline of 6.1% from the same time last year. Such fluctuations highlight the changing sentiments in the market.

-

Closed Sales: There were 55 homes sold in September, marking an increase of 37.5% from August's 40 sales. Compared to September of the previous year, sales have risen by 31%. The transaction boost might be influenced by several factors, including changing housing needs or seasonal buying trends.

-

Days on Market: Homes were listed for an average of 61 days before selling in September. This is longer by 24.5% compared to August's 49 days and a modest 4.3% increase from the 59 days last September. The longer duration can suggest buyers taking their time before making an offer.

-

List Price Received: Sellers received an average of 97.4% of their asking price, showing an improvement of 1.2% from August and a slight 0.3% boost from last year. This signals that while there might be more room for negotiations, sellers still achieve near their desired values.

-

Inventory: As of September, an estimated 4.6 months of inventory are available for homes in Park City. This represents a significant drop of 34.1% from August's 6.9 months and 25.7% less than the 6.1 months recorded last September. The reduced inventory underscores a competitive market scenario where demand is strong against a tightening supply.

Park City Condo Update - Sept 2023

Shifting our attention to the condo market in Park City, we observe some distinctive patterns that diverge from the single-family home sector.

In September 2023, the Park City condo market exhibited unique trends compared to single-family homes. The median sales price dropped to $1,145,000, a decrease of 11.9% from August and 4.3% year-over-year. Condo sales decreased with 45 units sold, marking a 13.5% reduction from the prior month and a significant 31.8% decline from last year. However, condos sold faster, averaging just 20 days on the market—a 52.4% decrease from August. Sellers received about 97.8% of their listing price, showing slight fluctuations from previous periods. Lastly, inventory increased to 4.4 months, suggesting a more balanced but tight market.

-

Median Sales Price: Condos had a median sales price of $1,145,000 in September, down 11.9% from August and a 4.3% dip from last year. The reasons for this decline can be multifaceted, ranging from a shift in the types of units sold to broader market sentiments.

-

Closed Sales: In September, 45 condos and townhomes were sold. This is a decrease of 13.5% from August's 52 sales and a substantial 31.8% drop compared to the 66 units sold during the same month last year. This decline could be attributed to various reasons, including changing consumer preferences or specific developments within the condo market.

-

Days on Market: Condos spent an average of 20 days on the market in September, a significant 52.4% decrease from August's 42 days and 25.9% less than the 27 days seen last September. This rapid turnaround indicates that condos are in high demand, and buyers are acting swiftly.

-

List Price Received: Condos were sold for approximately 97.8% of their listing price. This is a slight increase of 0.8% from August but a marginal dip of 0.2% from last year.

-

Inventory: The condo market now has about 4.4 months of inventory, up 12.1% from August's 3.9 months but 18.9% more than September of the previous year. This inventory growth can hint at a slower absorption rate, but it's essential to note that the market remains relatively tight, especially compared to historical standards.

In Conclusion, for September 2023, Park City Real Estate Trends

Park City's real estate market, buffered by a significant proportion of cash transactions, continues to demonstrate resilience despite broader financial pressures like rising interest rates. While there are indications of price adjustments and cautious buyer sentiment, the underlying fundamentals, especially in the single-family home segment, appear robust. The condo market requires close monitoring, as it shows early signs of softening, though demand remains relatively strong.

August 2023 Statistics and Trends

In recent months, it has taken some time to understand the dynamics driving the real estate market trends in Park City. The trends we're observing locally deviate considerably from narratives from buyers from other areas.

Single Family Homes - August:

-

Median Sales Price: There has been a tremendous rise of 67.6% in the median sales price since August 2022. This remarkable growth is particularly interesting, given that Park City seems somewhat insulated from the broader influences that typically impact the market, like interest rates.

-

Closed Sales: Sales have surged by 34.5%. This might be fueled by local factors or unique attributes of Park City that differentiate it from other regions.

-

Days on Market: Despite the robust growth in prices and sales, homes are taking 58.1% longer to sell than last year. This could indicate a more cautious buyer pool or unique transaction complexities in this market segment.

-

List Price Received: At 96.3% of the asking price (a slight decline from the previous year), sellers might be experiencing more negotiation, but they're still achieving near their asking prices.

-

Inventory: There's a slight uptick in new listings, but with active listings declining, it underscores the robust demand against a tight supply backdrop.

Condo and Townhomes - August:

-

Median Sales Price: A 10.2% increase year-over-year is healthy and signals a continued demand, although not as pronounced as in the single-family homes segment.

-

Closed Sales & Inventory: With modest growth in sales and a notable decrease in active listings and supply duration, the condo market also leans in favor of sellers.

-

Selling Time Increased: Despite strong demand, condos, like single-family homes, are taking significantly longer to sell.

The announcement of the Deer Valley Resort Area's expansion, including the Mayflower Mountain Resort, is expected to add significant value to Park City's appeal. This development promises to enhance the area's recreational offerings and will likely have a ripple effect on property values.

Given the unique dynamics of the Park City market and upcoming developments like the Mayflower Resort, we're optimistic about the prospects for real estate here. The trajectory indicates that Park City remains a robust investment opportunity, distinct from the experiences relayed by buyers from other regions.

Investors, homeowners, and potential buyers should monitor how these developments impact demand and supply in the coming years. Park City's unique position in the real estate market, bolstered by the resort expansion, paints a bright picture for future property values.

April 2023 Statistics and Trends

In April 2023, the real estate market in Park City, Utah, showed some interesting trends.

The median sales price for single-family homes in Park City and Snyderville Basin was $2,198,000, representing a 14.5% increase compared to the previous month. The average sales price also saw a notable rise, reaching $3,267,136, indicating a 14% increase from March. However, despite the price increases, the number of closed sales for single-family homes decreased to 22 in April, down from 32 in the previous month. The median sold price per square foot for single-family homes was $650, demonstrating a 10.5% increase. The percentage of list price received for homes remained consistent with the historical trend at 95% in April, though it was higher at 101% in the same month last year. The total sold dollar volume for single-family homes in April was $68,609,848, representing a 25% decrease from the previous month and a substantial 43% decrease compared to the previous year.

Looking specifically at condos and townhomes statistics, the median sales price for condos in April 2023 was $1,205,000, showing a slight decrease of 5.5% compared to the previous month. However, the average sales price for condos saw an 11.8% increase compared to the previous year, reaching $2,065,903. The number of closed sales for condos in April decreased to 43, down by 23.2% from the previous month. The median sold price per square foot for condos was $935, indicating a slight 0.4% decrease from the previous month. The percentage of list price received for condos was 97.3% in April, slightly lower than the 97.5% recorded in the previous month and higher than the 101.1% in the same month last year. The total sold dollar volume for condos in April was $88,833,837, indicating a 14.1% decrease from the previous month.

As an experienced real estate professional with a background in Park City's market, I've observed several trends in the current real estate market. Well-priced homes in good condition continue to attract buyers, and we're even seeing multiple offers in the sub $2 million range. Many buyers who postponed their purchase due to the excellent skiing conditions return in June, taking advantage of the opportunity to conduct thorough home inspections. May 2023 will be a strong month for our real estate team, as we have helped seven families buy or sell properties in Park City and the surrounding area. Drawing from my 20 years of experience in the industry, this market feels reminiscent of 2015 or 2017. As long as lending institutions maintain their current loan policies, I anticipate a relatively stable market in the foreseeable future.

Considering these insights, it is evident that the real estate market in Park City has experienced both positive and negative trends. While home prices have shown appreciation, the decrease in closed sales and total sold dollar volume for single-family homes and condos may suggest a slightly cooling market. As a real estate advisor, I recommend carefully assessing the current market conditions, including supply and demand dynamics, before making decisions. Additionally, it's crucial to consider long-term investment goals, financial capabilities, and personal circumstances when evaluating whether to purchase a property in Park City.

March 2023 Statistics and Trends

Market Insights for Single-Family Homes in March 2023:

In March 2023, the median sales price for a single-family home in Park City was $1,920,000, a 43.7% decrease from the prior period in 2022 when it was $3,115,000 and a 38.4% decrease from the previous month. In addition, the number of homes sold in Park City in March increased by 45.5% from the previous month but decreased by 13.5% from the same period last year.

Sellers of single-family homes in Park City are receiving 98.7% of their asking price, a 4.3% increase from last month. Additionally, 15.6% of homes sold above the list price indicate a resilient property market in Park City. However, pending homes decreased to 27 in March from 30 in February and 49 in 2022.

The number of new home listings increased by 26.9% from the previous month to 33, a 44.1% decrease from last year. The current supply of single-family homes in Park City is 5.4 months, a decrease from the previous month's 8.4 months.

For buyers interested in doomsday scenarios, the number of unsold homes in March 2023 was 17, which increased from 12 in February to 11 in March 2022.

Market Insights for Condos and Townhomes in March 2023:

In March 2023, the median sales price of a condo in Park City was $1,250,000, a 20.2% increase from the previous month but a 0.8% decrease from the previous year.

The number of closed sales increased by 96% from the previous month, from 27 to 53, but decreased by 37.6% from the previous year, as the year before included closing out some PENDRY ski condos.

On average, sellers of condos in Park City received 97.4% of the asking price, a 0.6% decrease from the previous month. Additionally, 9.4% of condos sold above the asking price.

Pending sales jumped 35.7% in March compared to February, with the median days on the market now sitting at 38 days.

There are currently 159 condos for sale in Park City, a 5.4% decrease from the previous month. The current supply of condos in Park City is three months, and 61 new listings were received in March, an increase from the 46 new listings received in February. However, it decreased from the 61 new condo listings in 2022. In addition, the number of unsold listings increased by four in March from 10 to 14.

Despite some fluctuations in the market, buyers and sellers are still actively involved in the real estate industry in Park City. However, it's important to note that Park City is a small market, and a few properties can heavily influence market trends.

Park City Market Trends and Outlook: While I have a positive outlook for the spring selling season, the Fed may continue to increase rates to balance the real estate market. For example, one client interested in buying a luxury home advises me to prepare for lowball offers, believing the market may soon fall. But, another client predicts that the Fed may decrease rates in late summer or early fall, which could lead to a stronger market than what's currently being observed.

Ultimately, we only have one life to live, so enjoying it to the fullest is important. Living Life on Vacation is possible in Park City, and the real estate market should be seen as a means to achieve that goal.

February 2023 Statistics and Trends

As a Park City real estate advisor, I've noticed buyers seem to be waiting to see what happens next with real estate in Park City. While sellers may be willing to negotiate a bit, it's important to note that they may not be as flexible as some buyers would like.

The snowy weather has made it challenging to show condos since many are rented out. This has made it difficult for buyers to view the properties they want. In February, some buyers have decided to wait until spring or early summer to purchase properties when inspections are easier to perform. Despite these challenges, properties in Park City are still closing every day.

This month, we saw notable changes in the prices and sales of single-family homes and condos in Park City.

Let's start with single-family homes. First, we can see the market's seasonality, as the median home price rose by a significant 37% from January to $3,215,000. In addition, home prices increased by 5.5% to $3,047,000 compared to last year's time frame. Although there were only 16 home sales in February, a 37.5% increase from January, it was still lower than the 34 sales from last year.

One positive note is that a healthy home supply is at 6.1% of inventory. However, many of these homes are either not yet built or require some updating, so the best homes are still selling quickly. It's also worth noting that the median days on the market for a Park City home are 52, and sellers receive 94.6% of the asking price.

Now, let's look at Park City condos. As previously mentioned, condos have been harder to show due to high rental demand, and the median sales price decreased by 25.7% from January to $1,400,000. Compared to last year's time frame, condo prices were down 16.3% to $1,242,500. Despite tying with January for 27 condo sales, the number of condo sales was down by a staggering 71.3% from last year, largely due to the new development of Pendry closing in 2022.

Currently, there is an 8.1 months' supply of condos in Park City. The median days on the market for Park City condos is 28 days, and sellers receive 97.9% of the asking price.

In summary, the real estate market in Park City for February 2023 has shown significant changes in single-family homes and condos. While single-family homes continue to sell at a healthy pace with increasing prices, condos have seen a decrease in prices and a notable drop in sales due to high rental demand and the closure of Pendry.

Updated February 2023

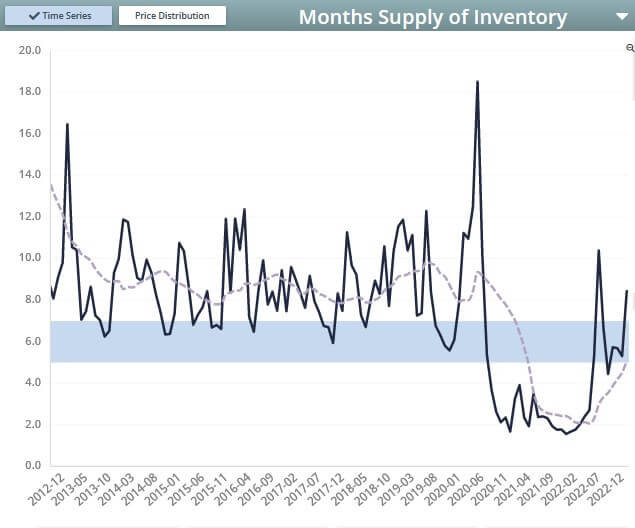

In January, interest rates relaxed slightly compared to the prior months, and inventory has been trying to return to pre-boom levels. To the right, you will see the months of supply for homes and condos in Park City, Utah. You'll notice we are finally starting to hit the midrange of the months of supply in the normal markets of 2013-2018. For January 2023, the number of home and condo listings is 362.

In January, interest rates relaxed slightly compared to the prior months, and inventory has been trying to return to pre-boom levels. To the right, you will see the months of supply for homes and condos in Park City, Utah. You'll notice we are finally starting to hit the midrange of the months of supply in the normal markets of 2013-2018. For January 2023, the number of home and condo listings is 362.

Below, we provide an update on the real estate trends in Park City, Utah, for January 2023. In this month's update, we compare the median sales price, closed sales price, active inventory, median days on the market, median sold per sq ft, and new listings for both homes and condos.

When comparing 2023 to 2022, we are coming off the real estate boom that started in 2020. Therefore, it might be wise to compare 2023 with the more stable markets of pre-boom 2020.

The largest closing for January was a little over $11.2 million in the ski-in-ski-out subdivision of Timberwolf Estates at Canyons Village. Silver Creek Village had four closings of around $ 1.1 million to $1.3 million. Looking back on sales for January of last year, many sold properties were ski-in-ski-out homes or in Promontory.

Regarding condos, the highest-priced sale in Jan 2023 was a Larkspur Townhome in Empire Pass for over $5.2 million. The lowest-priced condo was a studio in Canyons Village. In 2022, Pendry started closing on their new construction, which will skew the numbers below.

| Single Family Homes | Jan-23 | Prior Mo | 22-Jan |

| Median Sales Price | $2,347,500 | -3% | -19.1 |

| Closed Sales | 16 | -47% | -44.8% |

| Active Inventory | 193 | -4% | 103 % |

| Median Days on Market | 92 | 83% | 177.3% |

| Median Sold $/Sq Ft | 550 | -29% | -15.7% |

| New Listings | 42 | 2% | 42% |

| Park City Condos | Jan-23 | Prior Mo | 22-Jan |

| Median Sales Price | $1,400,00 | 54% | 1.8% |

| Closed Sales | 27 | -31% | -71% |

| Active Inventory | 169 | 3% | 61% |

| Median Days on Market | 46 | -10% | 1050% |

| Median Sold $/Sq Ft | 910 | 18% | -12.1% |

| New Listings | 44 | -12% | -35.3% |

Do You Own Real Estate in Park City, Utah?

Find Park City Property Values and what your home is worth today. As you can tell by the total market review on this page, property values are changing quickly in Park City. Contact me directly to discuss what your home in Park City or Deer Valley is worth.

Editor's Note: This is historical data to show the trends of the Park City Real Estate Market for 2023

Posted by Derrik Carlson on

Leave A Comment